Tokenized Bitcoin: Unlocking BTC's Potential and Future in DeFi

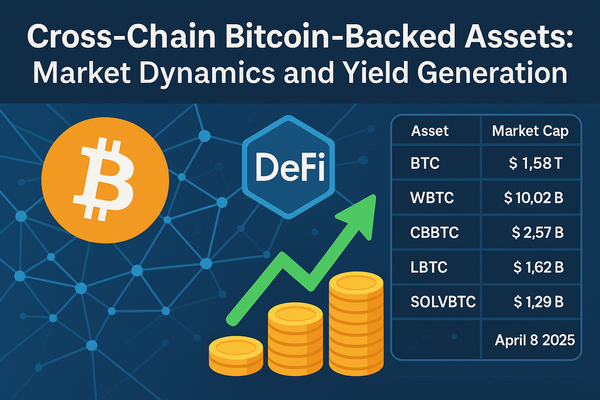

In the ever-expanding universe of cryptocurrency, Bitcoin stands as the original digital store of value—a $1.5 trillion colossus that has revolutionized our concept of money. Yet Bitcoin's native blockchain, for all its security and reliability, lacks the programmability needed for sophisticated financial applications. Enter tokenized Bitcoin: a technological innovation that wraps Bitcoin's value in smart contract-compatible tokens, unlocking its potential across decentralized finance (DeFi) ecosystems.

The Promise and Paradox of Wrapped Bitcoin

Tokenized Bitcoin solutions enable Bitcoin holders to participate in lending, trading, yield farming, and other DeFi activities without selling their underlying assets. This bridge between Bitcoin's immense capital base and innovative financial protocols creates unprecedented opportunities for yield generation and capital efficiency. However, these solutions inevitably confront a fundamental tension: the trade-off between centralization and decentralization, between liquidity and trustlessness, between convenience and philosophical purity.

The Tokenized Bitcoin Landscape

WBTC: The Centralized Heavyweight

Wrapped Bitcoin (WBTC), launched in 2018, dominates the tokenized Bitcoin market with approximately 147,000 tokens in circulation—representing 0.7% of Bitcoin's total supply. As an ERC-20 token custodied by BitGo and governed by the WBTC DAO, it offers unparalleled liquidity and seamless integration with major DeFi platforms like Aave and Uniswap.

However, WBTC's centralized custody model introduces counterparty risks that contradict Bitcoin's trustless ethos. Concerns about governance transparency, particularly following Justin Sun's involvement in 2024, have highlighted the vulnerabilities inherent in relying on trusted intermediaries.

SolvBTC: The Rising Challenger

Emerging in 2024, SolvBTC has rapidly accumulated an impressive $20 billion in total value locked (TVL). Operating across Ethereum, BNB Chain, and Arbitrum, this yield-bearing token combines decentralized governance through SOLV token holders with robust cross-chain capabilities.

SolvBTC's decentralized merchant and attester network significantly reduces custodial risks, while its multi-chain architecture provides flexibility for diverse DeFi applications. Though newer than WBTC, its innovative approach addresses many of the centralization concerns that plague its predecessor.

tBTC: The Decentralization Purist

Threshold Network's tBTC employs sophisticated threshold cryptography to create a truly decentralized alternative. With $2.22 billion TVL, it appeals to those who prioritize security and trustlessness above all else. Its complex minting process reflects a commitment to minimizing trust assumptions, though this complexity has limited mainstream adoption.

Beyond the Big Three

Other notable contenders include Function FBTC (emphasizing cross-chain integration), enzyBTC (utilizing decentralized committees for security), and the upcoming sBTC on Stacks (leveraging Bitcoin's own security model). Each represents a different approach to the central challenge of bringing Bitcoin into DeFi while preserving its core attributes.

The Custody Conundrum: Centralization vs. Decentralization

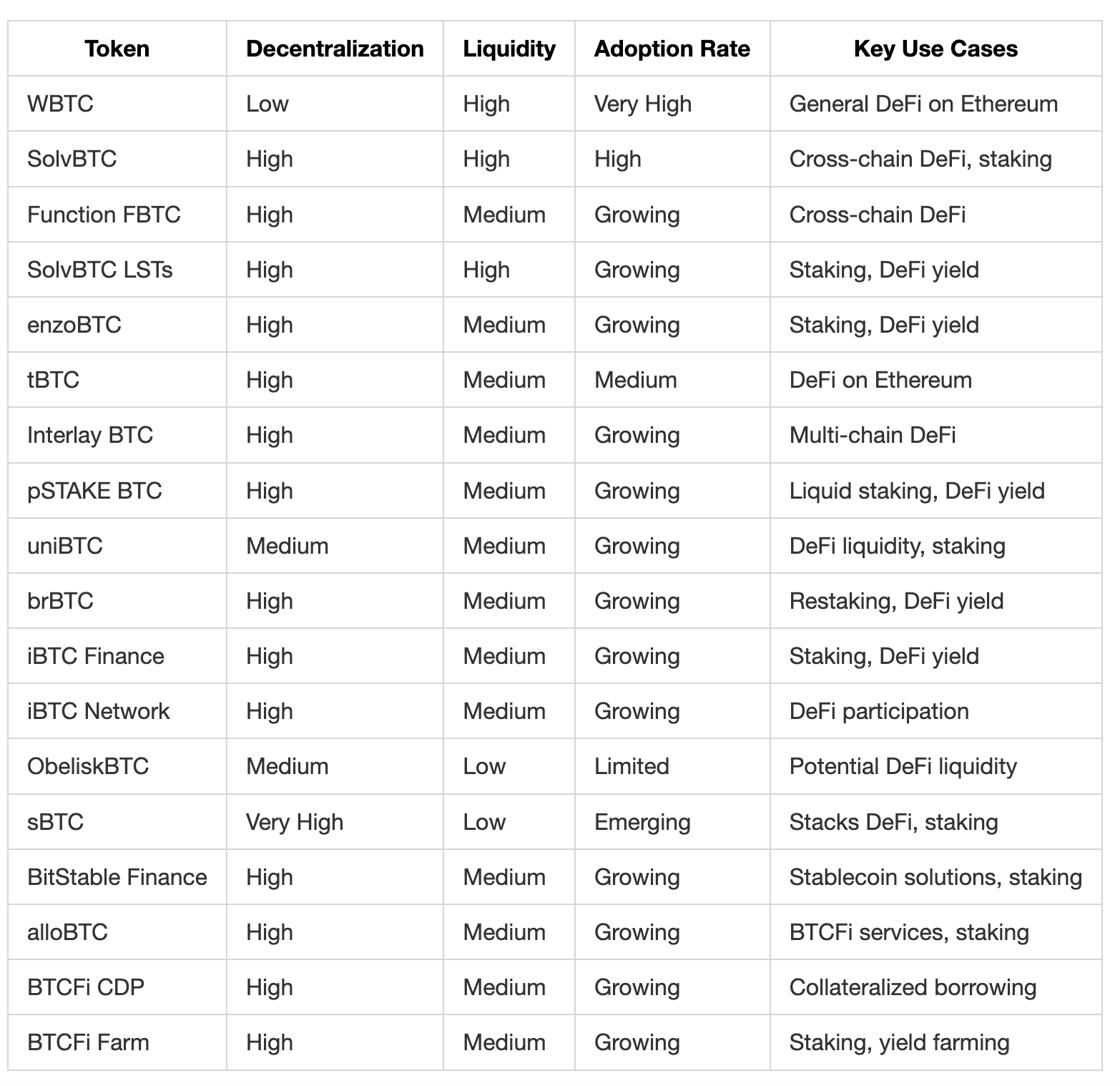

The debate over custody models represents the philosophical heart of the tokenized Bitcoin ecosystem. Centralized approaches like WBTC offer efficiency, user-friendliness, and deep liquidity, but at the cost of introducing trusted third parties. Decentralized alternatives distribute trust across networks, preserving Bitcoin's ethos but often sacrificing some degree of usability or liquidity.

This isn't merely a technical distinction—it reflects fundamentally different visions for DeFi's future. Is DeFi a pragmatic bridge between traditional and decentralized finance, where some centralization is acceptable for efficiency? Or is it a radical reimagining of finance that must minimize trust assumptions at all costs?

Profitability and Adoption Dynamics

For investors and users, several factors determine the relative attractiveness of different tokenized Bitcoin solutions:

- Liquidity Depth: WBTC's established position ensures tight spreads and high trading volumes, though SolvBTC is rapidly closing this gap.

- Yield Generation: SolvBTC and tBTC offer native staking and DeFi integration, potentially delivering higher returns than WBTC's market-driven opportunities.

- Market Confidence: SolvBTC's explosive growth to $20 billion TVL signals strong market trust, while tBTC's steady expansion reflects growing appreciation for decentralized approaches.

- Risk Profiles: Centralized solutions face regulatory and counterparty risks, while decentralized ones must contend with smart contract vulnerabilities and lower liquidity.

The Road Ahead

As DeFi continues to evolve, tokenized Bitcoin faces several transformative trends:

- Regulatory Clarity: Increasing regulatory attention will shape the viability of different custody models and cross-chain implementations.

- Cross-Chain Interoperability: Solutions that enable seamless movement between blockchains will likely capture increasing market share.

- Institutional Adoption: As traditional financial institutions enter the space, they may favor solutions that balance security with regulatory compliance.

- Technical Innovation: Advances in zero-knowledge proofs, threshold cryptography, and other technologies may resolve some of the current trade-offs between decentralization and usability.

Conclusion

Tokenized Bitcoin represents one of the most significant developments in cryptocurrency—a bridge between Bitcoin's established value proposition and DeFi's innovative potential. WBTC continues to dominate through sheer liquidity and first-mover advantage, but SolvBTC's hybrid approach and tBTC's commitment to decentralization offer compelling alternatives.

The choice between these solutions ultimately reflects not just financial calculations but deeper convictions about the future of finance. Those seeking maximum liquidity and established integration may prefer WBTC, while those prioritizing decentralization and cross-chain versatility might gravitate toward SolvBTC or tBTC.

As the ecosystem matures, we may see convergence toward solutions that effectively balance centralization and decentralization, liquidity and security, convenience and trustlessness. The tokenized Bitcoin space will remain a fascinating laboratory for these competing visions of financial innovation—a microcosm of the broader tensions shaping the future of DeFi.