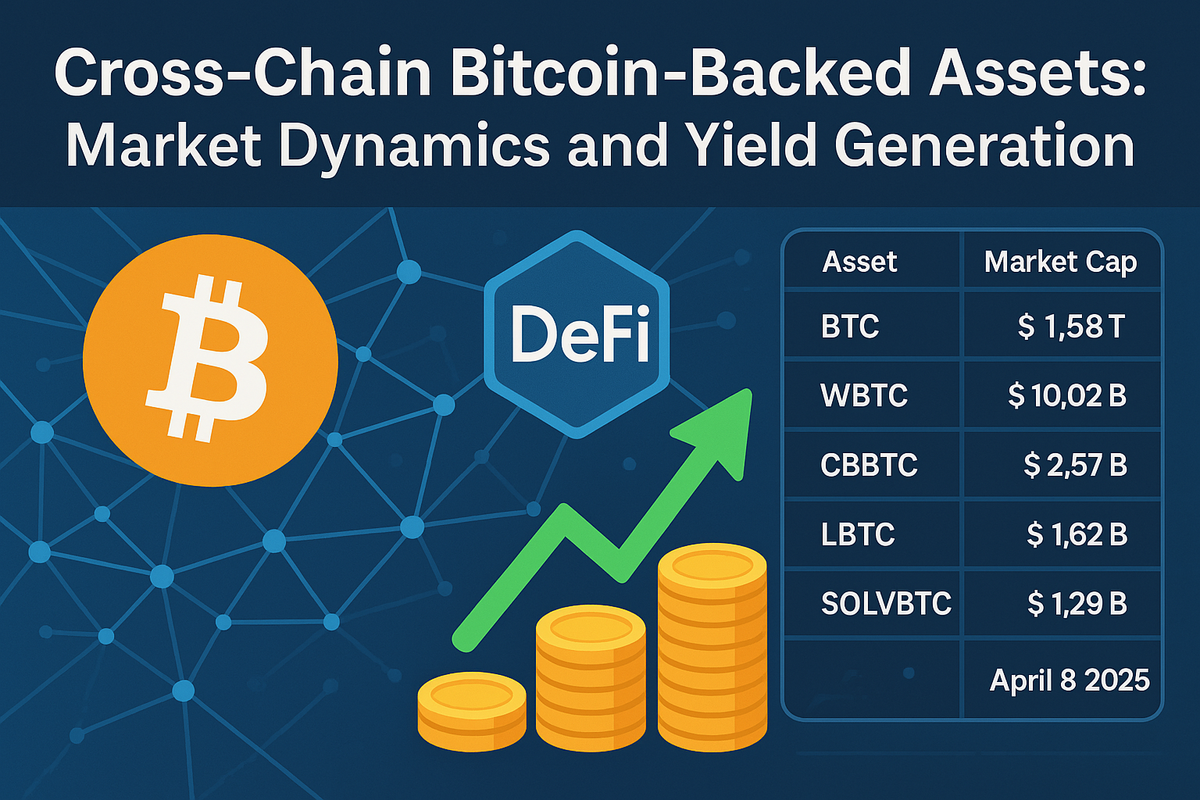

Cross-Chain Bitcoin-Backed Assets: Market Dynamics and Yield Generation

The intersection of Bitcoin and DeFi has created a sophisticated ecosystem of cross-chain Bitcoin-backed assets that expand Bitcoin's utility beyond its native blockchain. This research analyzes the market dynamics of Bitcoin-backed assets across different chains, explores their yield generation mechanisms, and examines their relationship with traditional Bitcoin mining economics as of April 8, 2025.

Market Overview and Evolution

Bitcoin-backed assets represent a significant portion of cross-chain value transfer in the cryptocurrency ecosystem. As of April 2025, the combined market capitalization of the major Bitcoin-backed tokens exceeds $15.4 billion, highlighting their importance in the broader DeFi landscape:

| Asset Name | Market Cap | Primary Chain | Generation Method |

|---|---|---|---|

| Bitcoin (BTC) | $1.58 trillion | Bitcoin | Proof-of-Work (PoW) mining, where miners receive block rewards for solving complex mathematical problems |

| Wrapped Bitcoin (WBTC) | $10.02 billion | Ethereum | Deposit BTC with custodians like BitGo, mint ERC-20 tokens on Ethereum 1:1 mapping |

| Coinbase Wrapped BTC (CBBTC) | $2.57 billion | Ethereum/Base | Convert BTC to CBBTC on the Coinbase platform, with Coinbase providing custody and minting equivalent tokens |

| Lombard Staked BTC (LBTC) | $1.62 billion | Ethereum/Multiple | deposit BTC into Lombard Protocol, which stakes it through the Babylon protocol to generate yield-bearing LBTC tokens |

| Solv Protocol SolvBTC (SOLVBTC) | $1.29 billion | Multiple | Users deposit BTC into Solv Protocol, which generates SOLVBTC through their Staking Abstraction Layer (SAL) |

The price disparities between these tokens (ranging from approximately $77,500 to $79,500) reflect various factors including market demand, liquidity differences, and the perceived risk profiles of different Bitcoin-backed assets.

Generation Mechanisms and Technological Approaches

Custodial Models

Wrapped Bitcoin (WBTC) pioneered the custodial model for Bitcoin-backed assets. Managed by the WBTC DAO, users deposit BTC with custodians like BitGo, which then mint equivalent ERC-20 tokens on Ethereum. This model prioritizes security through established custodians but introduces centralization risks.

Coinbase Wrapped BTC (CBBTC) follows a similar approach but leverages Coinbase's institutional-grade custody infrastructure. The integration with Coinbase's platform creates a seamless user experience for converting between BTC and CBBTC, driving its substantial adoption despite being a newer entrant to the market.

Decentralized Approaches

Threshold Bitcoin (tBTC) represents a significant shift toward decentralization in Bitcoin-backed assets. Rather than relying on a single custodian, tBTC uses threshold cryptography across a distributed network of validators. This approach enhances censorship resistance but introduces additional technical complexity.

Yield-Generating Models

Lombard Staked BTC (LBTC) innovates by combining Bitcoin backing with yield generation. Users deposit BTC into the Lombard Protocol, which then stakes these assets on the Babylon protocol. LBTC represents both the original Bitcoin value and the staking yield being generated, providing passive income while maintaining liquidity.

Solv Protocol SolvBTC (SOLVBTC) similarly leverages the Staking Abstraction Layer (SAL) to generate yield, allowing Bitcoin holders to participate in staking economics without sacrificing liquidity or direct Bitcoin exposure.

Cross-Chain Distribution and Liquidity

Bitcoin-backed assets now span multiple blockchain networks, with varying levels of adoption:

- Ethereum remains the dominant ecosystem for Bitcoin-backed assets, hosting approximately 82% of the total market capitalization across various tokens.

- Layer 2 Networks (particularly Arbitrum, Optimism, and Base) have seen rapid growth, now accounting for approximately 11% of Bitcoin-backed assets as users seek lower transaction costs.

- Alternative Layer 1 Chains like Solana, Avalanche, and BNB Chain have developed their own Bitcoin bridging solutions, though with more limited adoption (approximately 7% combined market share).

This distribution reflects both the historical dominance of Ethereum in DeFi and the ongoing evolution toward a multi-chain future where Bitcoin value flows seamlessly across various blockchain ecosystems.

Yield Generation Analysis

Bitcoin-backed assets generate yields through various mechanisms, each with different risk-reward profiles:

Lending Protocols

Lending Bitcoin-backed assets on protocols like Aave, Compound, and Spark provides relatively stable yields, typically ranging from 1.8% to 4.2% APY as of April 2025. These yields primarily derive from borrower interest payments and tend to fluctuate based on market demand for Bitcoin-backed collateral.

Liquidity Provision

Using Bitcoin-backed assets to provide liquidity on decentralized exchanges can generate yields between 3.5% and 11% APY, combining trading fees and liquidity mining incentives. However, this approach exposes providers to impermanent loss risk during periods of high volatility.

Native Staking Models

The newest category of yield generation comes from tokens like LBTC and SOLVBTC, which enable Bitcoin holders to access staking yields from proof-of-stake networks. These models typically generate 4.5% to 7.2% APY while maintaining exposure to Bitcoin's price action.

Relationship with Bitcoin Mining Economics

The growth of Bitcoin-backed assets has created complex interactions with traditional Bitcoin mining economics:

- Market Correlation: Both Bitcoin mining revenue and yields from Bitcoin-backed assets in DeFi tend to follow broader market trends. During bull markets, rising Bitcoin prices increase mining profitability while increased capital inflows to DeFi protocols often lead to higher yields. Conversely, bear markets typically see declines in both sectors.

- Capital Allocation Dynamics: When DeFi yields significantly outpace mining returns on investment, some capital may shift from mining operations to DeFi participation via Bitcoin-backed assets. This creates a feedback loop that can influence both mining difficulty and DeFi yields.

- Supply Impact: As more Bitcoin becomes locked as collateral for cross-chain assets, this effectively reduces the circulating supply of Bitcoin in its native ecosystem, potentially creating upward price pressure that benefits miners.

- Divergent Risk Profiles: Mining operations face unique challenges related to energy costs, regulatory considerations, and hardware depreciation, while Bitcoin-backed assets in DeFi contend with smart contract risks, bridge security concerns, and counterparty exposure. These different risk profiles prevent perfect arbitrage between the two investment approaches.

Risk Analysis and Security Considerations

Bitcoin-backed assets face several key risks that investors should consider:

Custodial Risks

Assets like WBTC and CBBTC rely on centralized custodians to secure the underlying Bitcoin. While these custodians employ robust security practices and regular audits, they represent potential single points of failure in the system.

Bridge Security

Cross-chain bridges that facilitate the movement of Bitcoin value between blockchains have been frequent targets for attacks. Historical vulnerabilities in bridge infrastructure have resulted in significant losses, highlighting the importance of robust security architecture in these critical components.

Smart Contract Vulnerabilities

The protocols that manage Bitcoin-backed assets on chains like Ethereum are susceptible to smart contract risks, including coding errors, economic design flaws, and governance vulnerabilities.

Market Risks

Price disparities between Bitcoin and its backed assets can emerge during periods of market stress, potentially leading to depegging events if redemption mechanisms cannot keep pace with demand.

Future Outlook and Emerging Trends

Several trends are likely to shape the future of cross-chain Bitcoin-backed assets:

- Increased Decentralization: The market is gradually shifting toward more decentralized models for Bitcoin backing, with protocols exploring innovations in threshold cryptography, zero-knowledge proofs, and distributed custody arrangements.

- Yield Optimization: Competition between different Bitcoin-backed assets will likely drive innovation in yield generation mechanisms, potentially creating more efficient ways to earn returns on Bitcoin holdings.

- Regulatory Adaptation: As regulatory frameworks for digital assets evolve, Bitcoin-backed assets will need to adapt to compliance requirements while preserving the core value propositions of accessibility and efficiency.

- Integration with Traditional Finance: Bitcoin-backed assets are increasingly being incorporated into traditional financial products, potentially expanding their utility beyond the crypto-native ecosystem.

- Technical Standardization: Efforts to standardize the technical implementations of Bitcoin-backed assets could improve interoperability and reduce fragmentation in the market.

Conclusion

Cross-chain Bitcoin-backed assets represent a significant evolution in Bitcoin's role within the broader cryptocurrency ecosystem. By enabling Bitcoin to participate in DeFi activities, these assets unlock new utility for the world's largest cryptocurrency while creating novel yield opportunities for holders. As the market continues to mature, we can expect further innovation in both the technical implementations and financial applications of these important bridge assets.

The relationship between Bitcoin-backed assets and traditional mining economics illustrates the growing interconnectedness of different sectors within the cryptocurrency ecosystem. For investors, understanding these dynamics provides valuable context for making informed decisions about capital allocation across mining, direct Bitcoin holdings, and DeFi participation through Bitcoin-backed assets.

As cross-chain technologies continue to advance, the boundary between Bitcoin and other blockchain ecosystems will likely become increasingly fluid, potentially accelerating the development of a truly interoperable multi-chain future where assets, including Bitcoin, can flow seamlessly to their most productive applications regardless of their native blockchain.